Poor Immigrants Use Public Benefits at a Lower Rate than Poor Native-Born Citizens

Low-income immigrants use public benefits like Medicaid or the Supplemental Nutrition Assistance Program (SNAP, formerly the Food Stamp Program) at a lower rate than low-income native-born citizens.1 Many immigrants are ineligible for public benefits because of their immigration status. Nonetheless, some claim that immigrants use more public benefits than the native born, creating a serious and unfair burden for citizens.2 This analysis provides updated analysis of immigrant and native-born utilization of Medicaid, SNAP, cash assistance (Temporary Assistance for Needy Families and similar programs), and the Supplemental Security Income (SSI) program based on the most recent data from the Census Bureau’s March 2012 Current Population Survey (CPS).

Low-income (family income below 200% of poverty line) non-citizen children and adults utilize Medicaid, SNAP, cash assistance, and SSI at a generally lower rate than comparable low-income native-born citizen children and adults, and the average value of public benefits received per person is generally lower for non-citizens than for natives. Because of the lower benefit utilization rates and the lower average benefit value for low-income non-citizen immigrants, the cost of public benefits to non citizens is substantially less than the cost of equivalent benefits to the native-born.

Background on Immigrants in the United States

About 40 million immigrants reside in the United States, comprising 12.9 percent of the total population.3 Of those immigrants, 43.8 percent are naturalized citizens and 56.3 percent are non-citizens—including undocumented immigrants.4 Immigrants are more likely to participate in the labor force,5 lack a high school degree,6 and to have incomes below the poverty line than the native-born.7 Immigrants begin with lower earnings but over time their incomes improve as they remain here.8

Immigrant Eligibility for Public Assistance Benefits

Immigrants’ eligibility for public benefits is based on specific aspects of their immigration status and state policies.9 Some key elements of the rules are:

- Citizenship. Naturalized citizens and U.S.-born children in non-citizen families are citizens. They are fully eligible for public benefits like Medicaid, the Children’s Health Insurance Program (CHIP), SNAP, cash assistance, and SSI, if they meet other program eligibility criteria.10

- Refugees and Asylees. Immigrants granted refugee or asylee status are generally eligible for public benefits if they meet program eligibility criteria.

- Lawful Permanent Residents. Lawful permanent residents (LPRs) must wait at least five years before they are eligible for benefits, but states have the option of providing them earlier.11 After five years, LPRs are eligible for federal benefits if they meet the program eligibility criteria. As exceptions, LPR children have been eligible for SNAP benefits since 2003 and states have been able to restore Medicaid benefits for children and pregnant women since 2009.

- Temporary/Provisional Immigrants. Temporary immigrants (e.g., work or student visa holders) are generally ineligible for public benefits, including the youth who are categorized as “Deferred Action for Childhood Arrivals.”

- Undocumented Immigrants. Undocumented immigrants are generally ineligible for the public assistance programs mentioned above.12

The unit of assistance (benefits received on an individual or family basis) and eligibility varies across programs. For Medicaid, CHIP, and SSI, benefits are provided to individuals and eligibility is individually determined. Thus many U.S.-born children in immigrant families receive health insurance through Medicaid or CHIP, but their noncitizen parents do not. SNAP and cash assistance provide household-level benefits. In many immigrant families, some family members are ineligible non-citizen immigrants, so the household SNAP allotment or cash assistance check is reduced. For example, if a very poor three-person family is composed of two LPR parents who have been here for two years and an American-born child, the benefit level is computed only using the child, not the ineligible parents.

Results

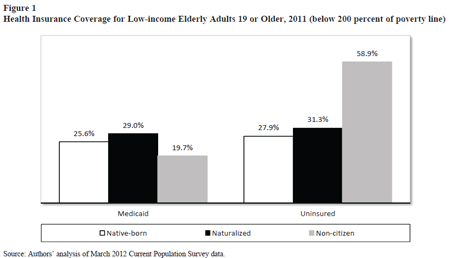

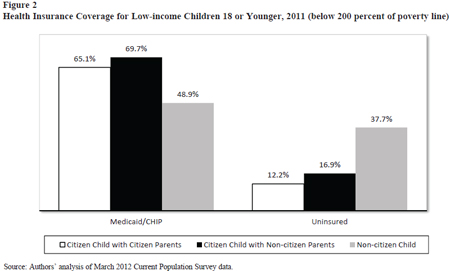

Medicaid/CHIP. Figure 1 shows that more than one quarter of native citizens and naturalized citizens in poverty receive Medicaid, but only about one in five non-citizens do so. Figure 2 shows that about two-thirds of low-income citizen children receive health insurance through Medicaid or CHIP, while about half of non-citizen children do so. Low-income non-citizen immigrants are the least likely to receive Medicaid or CHIP.

A major reason for these gaps is strict benefit eligibility barriers for many immigrants. Benefit use by poor immigrants was low even before the 1996 welfare reform, suggesting that eligibility factors are not the only reason for low levels of benefit use by non-citizen immigrants.13

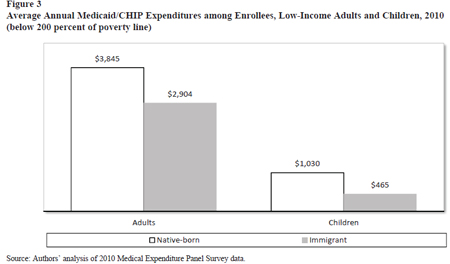

Figure 3 shows that immigrants who receive Medicaid or CHIP tend to have lower per beneficiary medical expenditures than native-born people, reducing the government cost of their benefits.14 Immigrant adults who received Medicaid or CHIP benefits in 2010 had annual expenditures about a quarter lower than adult natives. Immigrant children had average annual Medicaid expenditures that were less than one-half those of native-born children. Generally, immigrants have lower per capita medical expenditures than the native-born, regardless of type of insurance.15

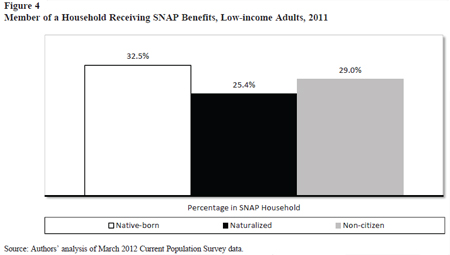

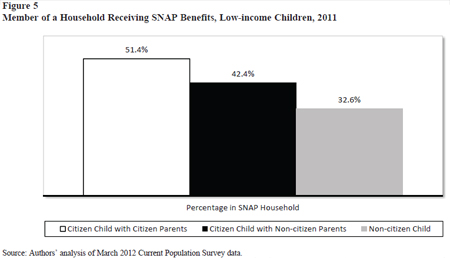

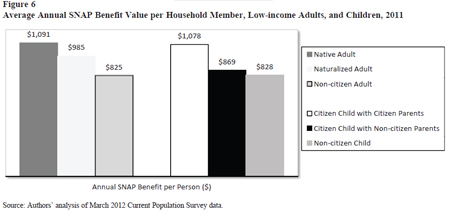

Supplemental Nutrition Assistance Program (SNAP). Figure 4 shows that among low-income adults, 33 percent of native citizens, 25 percent of naturalized citizens, and 29 percent of non-citizens received SNAP benefits in 2011.16 Figure 5 shows that about half of poor citizen children in citizen households receive SNAP, compared to about one-third of non-citizen children and two-fifths of citizen children in non-citizen-headed families. It is likely that the actual percentage of SNAP eligible non-citizen immigrants is even lower, but the gaps in the CPS data prevent us from knowing how large the gap is. Figure 6 shows that the average annual SNAP benefits per household member are about one-fifth lower for non-citizens than native adults or citizen children with citizen parents.

Cash Assistance and Supplemental Security Income

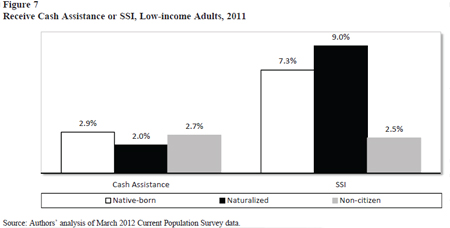

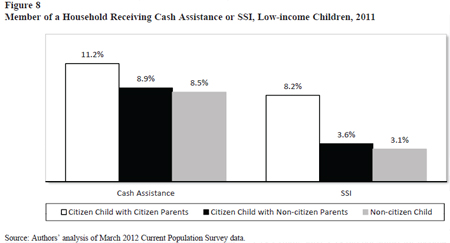

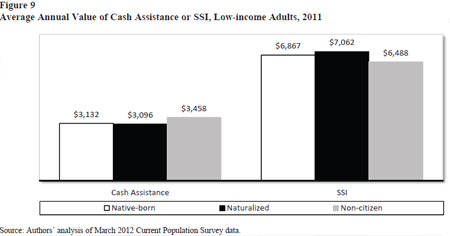

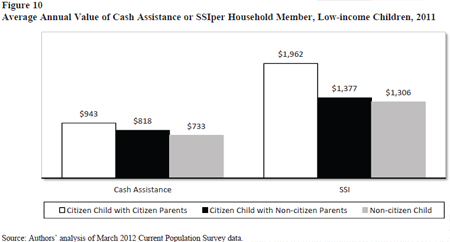

(SSI). Figure 7 shows that the SSI receipt was higher for native and naturalized citizens than non-citizen immigrants. 17 Figure 8 shows that children in households with non-citizen family members are less likely to be in households receiving cash assistance or SSI than citizen children living in full-citizen households.

Figure 9 shows that average annual cash assistance and SSI benefits for the native-born, naturalized, and non-citizens were very similar. In contrast, Figure 10 shows that the value of these benefits per household member was lowest for children living in non-citizen households. The cash assistance benefit for citizen children in non-citizen families was 13 percent lower, and the cash assistance for non citizen children was 22 percent lower compared to citizen children with citizen parents. The average SSI benefit was 30 percent to 33 percent lower for children in non-citizen families and non-citizen children than for citizen children in citizen families.

Comparing Studies

A study by the Center for Immigration Studies (CIS)found that immigrant-headed households with children used more Medicaid than native-headed households with children and had higher use of food assistance, but lower use of cash assistance.18 The CIS study did not examine the average value of benefits received per recipient.

There are several reasons why our study differs from CIS’s study. First, CIS did not adjust for income, so the percent of immigrants receiving benefits is higher in their study in part because a greater percent of immigrants are low-income and, all else remaining equal, more eligible for benefits. Non-citizens are almost twice as likely to have low incomes compared with natives.19 We focus on low-income adults and children because public benefit programs are means-tested and intended for use by low income people. It is conventional in analyses like these to focus on the low income because it reduces misinterpretations about benefit utilization.

Second, CIS focused on households headed by immigrants while we focus on individuals by immigration status. Our study focuses on individuals because immigrant headed households often include both immigrants and citizens. Since citizen children constitute the bulk of children in immigrant-headed households and are eligible for benefits, CIS’s method of using the immigrant-headed household as the unit of analysis systematically inflates immigrants’ benefit usage. For example, 30 percent of U.S children receiving Medicaid or CHIP benefits are children in immigrant-headed families and 90 percent of those children are citizens.20

Third, CIS focused on immigrants in general, including naturalized citizens, while we also included non-citizen immigrants. Naturalized citizens are accorded the same access to public benefits as native-born citizens and are more assimilated, meaning their opinions of benefit use are more similar to those of native born Americans. Separating non-citizens from naturalized Americans gives a clearer picture of which immigrant groups are actually receiving benefits.

Conclusion

Low-income non-citizen adults and children generally have lower rates of public benefit use than native-born adults or citizen children whose parents are also citizens. Moreover, when low-income non-citizens receive public benefits, the average value of benefits per recipient is almost always lower than for the native-born. For Medicaid, if there are 100 native-born adults, the annual cost of benefits would be about $98,400, while for the same number of non-citizen adults the annual cost would be approximately $57,200. The benefits cost of non-citizens is 42 percent below the cost of the native-born adults. For children, a comparable calculation for 100 non-citizens yields $22,700 in costs, while 100 citizen children of citizen parents cost $67,000 in benefits. The benefits cost of non-citizen children is 66 percent below the cost of benefits for citizen children of citizen parents. The combined effect of lower utilization rates and lower average benefits means that the overall financial cost of providing public benefits to non-citizen immigrants and most naturalized immigrants is lower than for native-born people. Non-citizen immigrants receive fewer government benefits than similarly poor natives.

Notes: This is a condensed version of Leighton Ku and Brian Bruen, “The Use of Public Assistance Benefits by Citizens and Non-citizen Immigrants in the United States,” Cato Working Paper, February 19, 2013, http://www.cato.org/publications/working-paper/usepublic- assistance-benefits-citizens-non-citizen-immigrants-united.

1. R. Capps, M. Fix, and E. Henderson, “Trends in Immigrants’ Use of Public Assistance after Welfare Reform,” in Immigrants and Welfare: The Impact of Welfare Reform on America’s Newcomers, M. Fix, ed. (New York: Russell Sage Foundation, 2009), pp. 123–52; and L. Ku, “Changes in Immigrants’ Use of Medicaid and Food Stamps: The Role of Eligibility and Other Factors,” in Immigrants and Welfare: The Impact of Welfare Reform on America’s Newcomers, M. Fix, ed. (New York: Russell Sage Foundation, 2009), pp. 152–92.

2. S. Camarota, Welfare Use by Immigrant Households with Children: A Look at Cash, Medicaid, Housing, and Food Programs (Washington: Center for Immigration Studies, 2011); S. Camarota, Immigrants in the United States: A Profile of America’s Foreign-Born Population (Washington: Center for Immigration Studies, 2012); and Office of Senator Jim DeMint, “Pickpocket: How Big Government Bureaucracy, Regulations, Taxes and Out-of-Control Spending Rob Taxpayers: One-third of Immigrants Households Use Welfare,” October 12, 2012, http://www.demint.senate.gov/public/index. cfm?p=pickpocket&contentrecord_id=c81c7eb2-3d1a-42a1- a3e5-a5c913f4fd23. Because Senator DeMint has resigned from the Senate to become President of the Heritage Foundation, this website has since been closed.

3. An immigrant is a foreign born person, except those born to American citizens living abroad.

4. The Census Bureau does not ask about non-citizen immigrant legal status.

5. Ibid.

6. Q. Ji and J. Batalova, “College-Educated Immigrants in the United States,” Migration Policy Institute, December 2012, http://www.migrationinformation.org/Feature/display. cfm?ID=927.

7. E. Grieco et al., “The Foreign-Born Population in the United States: 2010,” U.S. Census Bureau American Community Survey Reports (ACS-19), May 2012.

8. H. Duleep and M. Regets, “Immigrants and Human- Capital Investment,” American Economic Review 89, no. 2 (1999): 186–91; and H. Duleep and D. Dowhan, “Insights from Longitudinal Data on Earnings Growth of U.S. Foreign Born Men,” Demography 39, no. 3 (2002): 485–506.

9. Many of the key federal rules were established in 1996 by the Personal Responsibility and Work Opportunity Reconciliation Act, as amended by the Illegal Immigration Reform and Immigrant Responsibility Act, although there have been subsequent amendments in a variety of laws. For primary federal rules, see Office of the Assistant Secretary for Planning and Evaluation, Department of Health and Human Services, “Summary of Immigrant Eligibility Restrictions under Current Law as of 2/25/2009,” http://aspe.hhs.gov/hsp/immigration/ restrictions-sum.shtml. For a more comprehensive review, including state variations in policies, see National Immigration Law Center (NILC), Guide to Immigrant Eligibility for Federal Programs, 4th ed. (Los Angeles: National Immigration Law Center, 2002). In particular, see the NILC’s updates of laws and state options at http://www.nilc.org/guideupdate.html.

10. The Fourteenth Amendment to the U.S. Constitution begins: “All persons born or naturalized in the United States and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.”

11. See the NILC updates for more detail about state choices at http://www.nilc.org/guideupdate.html.

12. In Medicaid, payments to health care providers for emergency services are rendered to undocumented immigrants who otherwise meet Medicaid eligibility criteria (e.g., income, category, age). Emergency rooms, because of the Emergency Medical Treatment and Active Labor Act, are required to treat undocumented immigrants like other patients regardless of insurance status. The Medicaid provision helps ensure that reimbursement is available to the emergency care providers.

13. R. Capps, M. Fix, and E. Henderson, “Trends in Immigrants’ Use of Public Assistance after Welfare Reform,” pp. 123–52.

14. MEPS does not have information about citizenship, so we compare native-born vs. foreign-born low-income children and adults.

15. L. Ku, “Health-Insurance Coverage and Medical Expenditures for Immigrants and Native-Born Citizens in the United States,” American Journal of Public Health 99, no. 7 (2009): 1322–28; and S. Mohanty et al., “Health Care Expenditures of Immigrants in the United States: A Nationally Representative Analysis,” American Journal of Public Health 95, no. 8 (2005): 1431–38.

16. CPS data do not indicate which particular household members receive SNAP benefits, so all that can be determined is that a household received SNAP and that some members of the household are immigrants and some are not. If two citizen children are eligible for SNAP but their two immigrant parents are not, Census data only reveal that all four are part of a household receiving SNAP.

17. The CPS does not enumerate which children receive cash assistance and SSI benefits because the Census Bureau uses these data to compute adults’ incomes, but it does not compute income for children. The CPS data indicate which individual adults report receiving cash assistance and SSI but does not reveal which children received these benefits; we only know if they are members of households that received cash assistance or SSI. Thus, some immigrant children may be in families getting TANF or SSI benefits, but they may not be recipients.

18. S. Camarota, Immigrants in the United States: A Profile of America’s Foreign-Born Population (Washington: Center for Immigration Studies, 2012); and S. Camarota, Welfare Use by Immigrant Households with Children: A Look at Cash, Medicaid, Housing, and Food Programs (Washington: Center for Immigration Studies, 2011).

19. C. DeNavas-Walt, B. Proctor, and J. Smith, Current Population Reports, P60-243, Income, Poverty, and Health Insurance Coverage in the United States: 2011, U.S. Census Bureau (Washington: U.S. Government Printing Office, 2012).

No comments:

Post a Comment