The price of oil

Down it goes

The price of oil has fallen below $50 a barrel. Why that may not be entirely welcome news

A BARREL of oil could be bought for $47.36 in after-hours trading at the New York Mercantile Exchange on Monday December 1st. The price of oil is now at its lowest level in over three years and some $100 cheaper per barrel than at its peak in July. The latest drop came after members of OPEC, who had gathered for an emergency meeting in Cairo at the weekend, failed to agree to cut output quotas, despite tumbling demand. Many analysts expect the oil price to drop further.

Many will cheer the news. Governments that were struggling to deal with inflation earlier in the year are enjoying some relief. The world’s poorest, who spend as much as three-quarters of their income on getting enough to eat, were especially vulnerable to rising energy costs that helped to push up the price of food. Food riots erupted from Calcutta to Cameroon. With oil prices falling, and governments now more concerned about deflation than rising prices, those setting monetary policy have had no hesitation in cutting interest rates dramatically.

But not everything about a low oil price is a cause for cheer—nor is the dramatic volatility in the price a boon for consumers or producers. Most worrying is that the rapid recent decline is a symptom of a sharply worsening world economy: demand is dropping as economic activity stagnates, or slows, everywhere. More grim news about America's economy sent the Dow Jones Industrial Average down by 7.7% on Monday with Japanese markets following suit.

Environmentalists are not happy either. The recent period of high prices curbed appetites for oil and other forms of energy that result in emissions of carbon dioxide into the atmosphere. Although some have argued that demand for petrol is inelastic (in the short term drivers supposedly find it difficult to change their behaviour, or improve the fuel efficiency of their vehicles), anecdotal evidence and recent research suggest that responses to high prices were quick and significant.

A drop in sales of fuel-guzzling SUVs in America and increased use of public transport over the past year have been widely noted. And as petrol prices rose, people were more likely to scrap old cars, to buy more fuel-efficient models and to drive less. The result was lower consumption of oil and greater fuel efficiency of the fleet. Elsewhere it helped that many governments which had kept prices at the pump low through subsidies, reduced these. As a result more drivers were faced with paying closer to the true costs of their petrol use. But lower oil prices may reverse some of these trends.

Those concerned about energy security have reason to worry, too. Despite plans to increase the use of renewable energy and nuclear power—in the rich world, at least—oil will continue to represent a large share of energy needs, especially for transport. The long-term supply depends on continued investments in oil production, which is discouraged by low or volatile prices. Saudi Arabia says that $75 a barrel is needed to encourage new oil production to prevent a possible shortage in the future. The International Energy Agency, a rich-country energy watchdog, estimates that fresh sources of oil that could provide the equivalent to four times the current Saudi output will have to be found to maintain present levels of supply by 2030. If prices are low, this is less likely to happen, making a painful shortage more likely later on.

The price of oil would ideally reflect not only its demand and supply but take into account the damage that its use inflicts on the environment. But when oil is cheap, the hard decisions about investing in alternatives, inventing more energy-efficient plants and machinery, or changing consumer behaviour, all of which would help the world can wean itself off oil, become that much easier to postpone.

Travels With Hillary

Two Secretaries of State for the price of one.

Barack Obama's choice of Hillary Clinton to be his Secretary of State is either a political master stroke, or a classic illustration of the signature self-confidence that will come back to haunt him. We're inclined toward the latter view, but then Mr. Obama is the one who has to live with her -- and her husband.

The President-elect's political calculation seems clear enough: Better to have the Clinton machine as allies than as critics on the outside of his Administration. His early choices are loaded with Clintonians of various stripes, from John Podesta to run his transition team, Rahm Emanuel as White House chief of staff, Eric Holder at Justice, and now the former first lady herself as chief diplomat.

This is startling for a candidate who explicitly promised Democrats in the primaries that he offered an escape from the Clinton political method. But perhaps Mr. Obama figures any disillusion will be minor and that this will unite the Democratic Party behind him. Much as retaining Robert Gates at the Pentagon may mute attacks from some Republicans, the choice of Mrs. Clinton will help to insulate Mr. Obama from attacks by fellow Democrats. He also disarms the Clinton campaign and fund-raising machinery for any potential challenge in 2012.

These political calculations must be predominant, because Mrs. Clinton brings no special policy expertise to the job. Her best attribute may be her undeniable work ethic. She has focused on foreign policy in her Senate committee assignments, but without much notable influence on policy or events. Her criticism of the Bush foreign policy has echoed the conventional view that the Administration wasn't diligent enough in trying to talk to the Iranians, the North Koreans and other hard cases. In other words, Mrs. Clinton is likely to pick right up where Condoleezza Rice and Nick Burns left off trying to negotiate with these enemies in the second Bush term.

It's also strange if Mr. Obama is trying to invoke the Clinton Presidency as a foreign-policy golden age. We recall it mostly as an era of illusory peace as problems festered with too little U.S. attention. Al Qaeda was left unchecked, Saddam Hussein banished U.N. inspectors and exploited Oil for Food, North Korea embarked on a secret nuclear program, Russia's post-Cold War spring faded, and Pakistan's A.Q. Khan spread nuclear-bomb technology around the world.

Mr. Obama's biggest gamble is associating his Presidency with the Clinton political circus. At least as Secretary of State, Mrs. Clinton will have a specific role, as opposed to the ill-defined mandate of a Vice President. (Speaking of the Veep-elect, with Mr. Gates and the Clintons around, what's left for Joe Biden to do? State was the job he's long wanted, and he must be dying inside trying to abide by Team Obama's gag order.)

But that still leaves Bill Clinton and his gift both of irrepressible gab and for inevitable controversy. His post-Presidency has been more or less a vast fund-raising operation -- for himself, his library and legacy, and his charitable causes. Mr. Obama said yesterday that Mr. Clinton has agreed to disclose the 200,000 or so donors to his foundation, and what a list it is likely to be. Look for Arab sheikhs, Latin American monopolists and assorted dubious characters.

The potential for blatant conflicts of interest with Mrs. Clinton's new role is great, and in appointing her Mr. Obama seems to be betting that the disclosure will diminish the problem. Given the Clinton history with the Riadys of Indonesia, Johnny Chung, the Lippo Group and Arkansas compadre Thomas "Mack" McLarty's business travels through the Americas, we hope the President-elect knows what he's getting into. The Senate has an obligation to inspect and make public the Clinton global fund-raising machine check by check, with names, dates and precise amounts.

In choosing Mrs. Clinton, Mr. Obama is also hiring someone he can't easily fire. This is usually a mistake, as President Bush learned with Colin Powell. The ability to let an adviser take the blame for a policy blunder is crucial to protecting Presidential credibility. But if Mr. Obama tries to let Mrs. Clinton go, he will be taking on the entire Clinton entourage -- not just Bill, but Carville, Begala, Ickes, Blumenthal, McAuliffe and so on. That same chorus will work to burnish her reputation via media leaks at the expense of her colleagues -- and the President -- when there is a mistake to explain.

Perhaps Mr. Obama will prove to be crafty enough to manage all of this and the other egos he is assembling. One good sign is that his choice as his National Security Adviser, former Marine General James Jones, is a commanding enough presence to mediate bureaucratic disputes. Mr. Bush and Ms. Rice never adequately did that in their first term.

On the other hand, the transition spin that Mr. Obama's Cabinet choices are inspired by Abraham Lincoln's "Team of Rivals" also suggest more than a little hubris. Honest Abe had to deal with jealous advisers and treacherous generals to win the Civil War. We're not sure even that would be adequate preparation for the raucous, uncontrollable political entitlement that has always driven the Clintons.

Governors Against State Bailouts

Hard to believe, but not everyone in politics wants a free lunch.

RICK PERRY and MARK SANFORD

As governors and citizens, we've grown increasingly concerned over the past weeks as Washington has thrown bailout after bailout at the national economy with little to show for it.

In the process, the federal government is not only burying future generations under mountains of debt. It is also taking our country in a very dangerous direction -- toward a "bailout mentality" where we look to government rather than ourselves for solutions. We're asking other governors from both sides of the political aisle to join with us in opposing further federal bailout intervention for three reasons.

First, we're crossing the Rubicon with regard to debt.

One fact that's been continually glossed over in the bailout debate is that Washington doesn't have money in hand for any of these proposals. Every penny would be borrowed. Estimates for what the government is willing to spend on bailouts and stimulus efforts for this year reach as much as $7.7 trillion according to Bloomberg.com -- a full half of the United States' yearly economic output.

With all the zeroes in the numbers, it's no wonder Washington politicians have lost track.

That trillion-dollar figure is the tip of the iceberg when it comes to checks written by the federal government that it can't cash. Former U.S. Comptroller General David Walker puts our nation's total debt and unpaid promises, like Social Security, at roughly $52 trillion -- an invisible mortgage of $450,000 on every American household. Borrowing money to "solve" a problem created by too much debt seems odd. And as fiscally conservative Republicans, we take no pleasure in pointing out that many in our own party have been just as complicit in running up the tab as those on the political left.

Second, the bailout mentality threatens Americans' sense of personal responsibility.

In a free-market system, competition and one's own personal stake motivate people to do their best. In this process, the winners create wealth, jobs and new investment, while others go back to the drawing board better prepared to try again.

To an unprecedented degree, government is currently picking winners and losers in the private marketplace, and throwing good money after bad. A prudent investor takes money from low-yield investments and puts them in those that yield better returns. Recent government intervention is doing the opposite -- taking capital generated from productive activities and throwing it at enterprises that in many cases need to reorganize their business model.

Take for example the proposed Big Three auto-maker bailout. We think it's very telling that each of the three CEO's flew on their own private jets to Washington to ask for a taxpayer handout. No amount of taxpayer largess could fix a business culture so fundamentally flawed.

Third, we'd ask the federal government to stop believing it has all the answers.

Our Founding Fathers were clear and deliberate in setting up a system whereby the federal government would only step in for that which states cannot do themselves. An expansionist federal government of the last century has moved us light-years away from that model, but it doesn't mean that Congress can't learn from states that are coming up with solutions that work.

In Texas and South Carolina, we've focused on improving "soil conditions" for businesses by cutting taxes, reforming our legal system and our workers' compensation system. We'd humbly suggest that Congress take a page from those playbooks by focusing on targeted tax relief paid for by cutting spending, not by borrowing.

In the rush to do "something" to help, federal leaders would be wise to take a line from the Hippocratic Oath, and pledge to do no (more) harm to our country's finances. We can weather this storm if we commit to fiscal prudence and hold true to the values of individual freedom and responsibility that made our nation great.

Mr. Perry, a Republican, is the governor of Texas. Mr. Sanford, a Republican, is the governor of South Carolina.

Mumbai and Obama

Lessons in security and diplomacy.

President-elect Obama said yesterday that terrorists based in South Asia represent "the single, most important threat against the American people." As he prepares to become responsible for American safety, we hope he's also absorbing some of the lessons of the Mumbai massacre.

Mumbai obviously lacks the antiterror resources and police sophistication of New York City. Yet as a similarly open society, America is in many respects just as vulnerable as Mumbai to murderous attacks by gunmen on soft targets such as train stations, hotels and hospitals. Al Qaeda has so far avoided such attacks in the West, preferring more spectacular bombings. But the very "success" of the Mumbai attacks in capturing world attention and closing down a commercial center for three days might cause Islamists elsewhere to copy their method.

In the U.S., good intelligence has thwarted several armed terrorist attacks that we know about and, presumably, more that we don't. Five men are currently on trial in Camden, New Jersey, charged with planning an attack on Fort Dix. Three men are serving time for a 2005 plot to blow up military sites, synagogues and other Jewish sites in southern California. The Obama team might want to reconsider their views on the Patriot Act, wiretapping, terrorist interrogation, and other measures that help law-enforcement officials gather crucial data that make it possible to stop such plots.

At his news conference, Mr. Obama declined to say whether the Indian government would be justified in pursuing terrorists in neighboring Pakistan -- as he had suggested during the campaign that the U.S. do with al Qaeda, and as the U.S. is doing now with Predator attacks against al Qaeda and Taliban targets. The U.S. would be engaged in some "delicate diplomacy" in the coming days, he properly said, and it would be "inappropriate" for him to comment.

But soon enough he'll assume the diplomatic challenge of keeping tensions between Pakistan and India from exploding. Pre-Mumbai, Pakistan's new President, Asif Ali Zardari, had already pledged to improve ties with India. Post-Mumbai, he's renewed that promise. The best outcome would be for Islamabad itself to take action against the terrorists who use Pakistan as a training ground and staging point for attacks on India.

Failing that, Indian Prime Minister Manmohan Singh will be under pressure to take the same kind of military action that Candidate Obama endorsed for the U.S. Yet an Indian incursion into Pakistan at the current moment, however justified in self-defense, might do more harm than good to Indian security. It could inflame anti-India sentiment in Pakistan, or perhaps it could lead to the fall of the Zardari government and the rise of former Prime Minister Nawaz Sharif, who is allied with Pakistan's religious parties. In the worst case, the destabilization of Pakistan would create an opportunity for an Islamist takeover and all that would portend.

After months without a major attack, Mumbai has reminded everyone that the Islamist terror threat is far from defeated. So much the better if it serves as early instruction for the security team that Mr. Obama introduced yesterday.

We will bounce back sooner than people think

My hunch is that the financial markets will make a sharp recovery next year. But the overmortgaged West will pay a price

W e now know that 2009 is going to be very, very tough, particularly the first half of it. A number of our clients are battening down the hatches and there is considerable gloom about.

I was in Washington last week for The Wall Street Journal CEO Council event. At it 95 chief executives were asked when they thought there would be a recovery. Half said in 2010, the other half 2011.

I think it will be sooner, because the market is missing the extent of the fiscal stimulus that the Obama administration is expected to announce. It will be colossal – the number $500 billion has started to appear in the past few days – although, for it to work, people must act together and not independently.

So, my guess is that by mid2009 we will see a very sharp comeback in the financial markets, although it will remain tough in the real world. By 2010 the world will start to pick up.

Of the four “Bric” economies – Brazil, Russia, India and China – India will do best next year. While its growth next year will be down on 2008, China will still grow by between 7-9 per cent. It must, to avoid social unrest. Brazil will grow by between 2-3 per cent, Russia will be under pressure, but the “next 11” countries – including Vietnam, Bangladesh, Mexico and Nigeria – have very reasonable growth prospects. But with the world economy growing by 1 per cent overall, it means that the West will be down – the US, the UK and the eurozone.

At the WSJ event, the speakers included Larry Summers, Henry Paulson and Robert Rubin. To a man, they all said that what the US needed was a sharp fiscal stimulus. Remember, all these people have influence on Barack Obama.

As close to Mr Obama’s inauguration on January 20 as possible, we will see that big package for stimulating the economy announced. It may take the form of a reduction in tax rates, Keynesian infrastructure projects or accelerated capital allowances for research and development.

As well as all that, we will see the US car industry bailed out. But this will happen before the inauguration because there are fears that General Motors will go under before Christmas. Politically, Mr Obama couldn’t have a black woman car worker being put out of work in Detroit while a white debt trader in New York is kept in work.

People also forget that in 2010 the new President faces midterm congressional elections. So he has only one year and nine months before he has to face the voters again – the political need to get a stimulus in place is huge. Think back to Bill Clinton in 1994 and George Bush in 2006. Both were caught out by the midterms, and this will weigh heavily on Mr Obama’s mind.

What concerns me, however, is that, while there will be a massive fiscal stimulus, there have been no commitments from the banks to start lending again.

It was also striking in Washington that, while those three wise men agreed that a stimulus was necessary, they did not focus on how it will be paid for in the longer term. We are mortgaging the future. Everyone in the US is concentrating on how to get through the present crisis – but ignoring the issue of how to pay for it.

By 2010 the West will be living with the long-term consequences of what has happened, and will be overborrowed. India, China and the other Brics will continue to pull away while we are increasingly indebted, having mortgaged our future.

This could result in capital-rich countries such as Russia, China and Japan having to support the dollar – just as the US supported sterling in the 1950s. And that could lead to situations such as the Suez crisis, where members of Eisenhower’s Administration called Anthony Eden to tell him “unless you end your Egyptian adventures, we are going to sell our sterling assets”.

India and China have been on the wrong side of history for the past couple of centuries, but now, things are going their way. We cannot fight that. For Britain, the risk is that we react to this by withdrawing, by becoming more protectionist, more populist in our economics.

The same applies to Western Europe. For my company WPP, there is no point in continuing to invest in Western Europe unless structural changes are made. For example, if we win a piece of business, we have to bear the severance costs of the company that lost the contract.

Western Europe is like an ageing company with huge healthcare and pension liabilities that are difficult to fund. That is why admitting Turkey to the EU should be a no-brainer. It is the gateway to the Middle East, has a young population, is highly entrepreneurial and would be a huge boost to the EU’s 450 million people.

In the UK, all the changes that Margaret Thatcher made have gone. When I visit Scotland and Wales, and see the extent to which local jobs depend on the public sector, it shows we have lost all the progress made under her. Governments can invest plenty of money on retraining people but, unless we can change more aggressively, we will be unable to compete. We are back where we were in the 1960s and 70s.

The exception to all of this is America. People wrote off the US in the 1980s and said that Japan would take over the world. But then along came Ronald Reagan. He changed the dynamics. What the world really needs right now is leadership in the Reaganite, Thatcherite, Blairite mould to lead us out of this crisis.

Mr Obama could be that person. I look at Barack Obama and it takes me back to when I was 18, to when John F. Kennedy was elected. Mr Obama is young, smart, a wonderful orator and represents a new hope, a new era. JFK was just the same and he changed the attitudes of my generation. That’s what the world needs now from Mr Obama.

A Bullish Black Friday

Brian S. Wesbury and Robert Stein,Post-Thanksgiving shoppers spent more than expected.

|

|

The current recession is unlike any other in the last couple of generations. Usually recessions happen because monetary policy gets tight or tax rates go up. Or, sometimes, like in the Great Depression, both of these plus rising trade barriers lead to a contraction in economic growth.

This time around, the recession is not due to tight monetary policy, higher tax rates or protectionism. It's due to a sudden and sharp plunge in the velocity of money--what we have been calling "risk aversion hysteria." This is where the speed with which money moves its way through the economy slows down as both consumers and businesses decide they want to increase their cash holdings.

Idiotic mortgage loans started the financial fire and overly stringent mark-to-market accounting rules acted as an accelerant, forcing financial firms to write down the value of their assets even when underlying mortgage cash flows were likely to grossly exceed fire-sale prices for mortgage securities.

When it appeared that money in banks and money market funds was no longer safe, consumers decided they would rather have money under mattresses instead of in bank accounts. This panic caused a sharp decline in consumer spending. Retail sales (excluding autos) grew 6% during the year ended in June, but just 1% during the year ended in November. With auto sales included, retail sales fell 4.1% in the year ended in November.

But fresh data on what's been happening on Main Street the past few days suggest the plunge in velocity may be either coming to an earlier end than most analysts expected, or that velocity may even be accelerating.

The National Retail Federation (NRF) says the number of shoppers either in stores or accessing online retailers, from Black Friday through Sunday, was up 17% versus last year and that the average amount spent was up 7.2%. According to the NRF, shoppers were busy buying clothes and electronics. Meanwhile, ShopperTrak, which monitors sales at shopping centers and malls around the country, says Black Friday sales were up 3% versus last year.

Obviously, these figures should be greeted with caution. The NRF numbers are based on a poll of consumers, not actual sales volumes, and the ShopperTrak data is for Black Friday only. It is plausible that, with relatively few shopping days this year between Thanksgiving and Christmas, consumers are buying more on a per day basis but will not buy more during the holiday season as a whole.

Obama and jobs

Alfred Tella

President-elect Barack Obama has proposed a new fiscal stimulus plan designed, in his own words, to "save or create" 2.5 million jobs in the first two years of his administration.

The word "save" is worthy of note. It subtly introduces politics into what otherwise would have been an objective target capable of evaluation. No matter what the job count turns out to be in January 2011, it's always possible - and unprovable - to say the jobs "saved" are 2.5 million more than would otherwise have been the case, i.e., without the stimulus. The "otherwise" scenario is, of course, an unknown quantity, whereas actual net job creation is statistically observable.

Is a two-year 2.5 million jobs program timid or ambitious? If successful, how much of a job market dent is it likely to make?

If jobs in the next few months continue to decline as they have in the last few months - not an unrealistic expectation in our current economic predicament - then in January 2009 when Mr. Obama takes office, the job count will be down to about 136.2 million, or 1.8 million below a year earlier.

As the recession has worsened, job losses have accelerated. Economists predict 2009 will be another year of declining employment, more severe than in 2008. In this time of unusual financial and economic turmoil, the downturn in the labor market looks to be long and deep, more like the recession of 1981-82 than the recession of 2001. The job recovery, when it comes, will more likely be gradual than robust.

In his effort to create jobs, particularly in 2009, the president-elect will be fighting an uphill battle. Population growth will continually add to the work force and, judging from worker behavior this year, labor force participation will remain high, making it harder to reduce unemployment.

In the current recession to date, the proportion of the working-age population in the labor force has held steady rather than declining as in past recessions, probably reflecting the unusual combination of job insecurity and uncertainty coupled with asset loss. A continuation of this trend means the participation rate will not shave the unemployment count as it has in past recessions, and more jobs will be needed to offset the pressures of population growth.

If, as expected, the recession persists throughout the first year of the Obama administration and the rate of job loss independent of the stimulus plan is comparable to the 1981-82 recession, then the predicted job total for January 2010 is about 133 million, or 3.2 million less than the job count at the beginning of Mr. Obama's term. A job loss of that amount added to this year's unemployment would be consistent with a jobless rate in excess of 8 percent.

Assuming there is a moderate economic recovery in the second year of Mr. Obama's administration, there could be enough of a rise in jobs to offset an increase in jobseekers due to population growth. However, that would still leave the 8 percent-plus unemployment rate predicted for January 2010 about unchanged a year later. By this scenario, the net loss in jobs for the first two years of the Obama administration independent of the stimulus plan comes to about 2 million.

So if Mr. Obama's stimulus package succeeds in "saving" those 2 million jobs and creates an additional half million to meet his overall goal of 2.5 million jobs, how pleased should we be?

By historical standards, a 2.5 million or 1.8 percent job-creation goal over a two-year period is a modest target. Some say it is deliberately modest so political credit can be claimed if the goal is surpassed. However, an economy with an unemployment rate two years into a new administration that is more than a percentage point higher than when Mr. Obama took office would not, in the eyes of many, be deemed an overwhelming achievement.

Nevertheless, in these difficult times whatever number of jobs that can be created in the next two years will be welcome, be it by the private sector or government. Every new job is a treasure and it's less important who gets the credit for job creation than it is that the jobs become available and give a badly needed boost to the economy. Some of the jobs will leak to other countries, but that's unavoidable. Including tax reduction as part of the recovery strategy will go a long way in helping to raise employment.

We can hope the new administration will avoid policies that further bind the "invisible hand" and instead allow the self-correcting forces in the marketplace to help return us to economic prosperity.

Alfred Tella is former Georgetown University research professor of economics.

How to Return to a Gold Standard

By Carlos PedreraTwo weeks ago the leaders of the world met for what many referred to as Bretton Woods II. What transpired was one of the greatest misreads of cause and effect that the policy world has ever seen.

The G20 heads ostensibly got together to try and fix all the financial ills that have befallen us since the U.S broke the dollar’s link to gold in 1971. But judging by the news that leaked out, any policy that might result will surely bring more regulatory complexity to a world economy that presently needs less. In short, our leaders know not why we are struggling. The answer lies in a dollar that lacks definition.The goal of Bretton Woods II should have been to repeat the result achieved during the 1944 confab, which was to link the value of the U.S. dollar to gold. If this should somehow happen going forward, the dollar would take on magnetic qualities for its ability to attract capital from around the world. Of perhaps greater importance, in one year’s time most of the world’s currencies would be linked to the U.S dollar at different ratios. As a result, currencies the world over would have a stable gold definition.

But didn’t the first Bretton Woods fail? And if we re-linked the dollar to gold, wouldn’t we be setting ourselves up for failure again? The great thing about history is that it can be studied to understand why we achieved a result that we did not expect. It has been known for quite some time why the original Bretton Woods system failed; therefore, we can create a new system that fixes those flaws.

The first mistake made under the old system had to do with the U.S. government being given full power to maintain the dollar link at 1/35th of an ounce of gold. This was not considered a flaw in 1944 because at the time, it was seemingly inconceivable that the U.S would decide to break the gold link by inflating in the way it did.

Nevertheless, this is exactly what happened in the mid to late 1960’s. At the core of the original 1944 world dollar standard was a convertibility feature that allowed foreign banks to exchange dollars for physical gold if the U.S started to inflate.

This basic form of convertibility served as an essential signal for U.S. monetary authorities when it came to knowing whether too many or too few dollars were being created. The system worked well for three decades due to the fact that the U.S kept its promise when it came to maintaining the integrity of the dollar-gold link.

With the dollar defined in terms of an historically stable commodity, the United States economy and economies around the world prospered tremendously in the 1950s and ‘60s. However, by the mid ‘60s, monetary authorities stateside began to break their promises with regard to the dollar, which set off a chain reaction throughout the dollar-linked world.

Simply put, the U.S turned on the dollar printing presses and refused to turn them off. And with the world awash in greenbacks, the aforementioned convertibility feature served its market purpose in revealing U.S. monetary error.

In short, by the late ‘60s and early ‘70s there was a marked increase when it came to foreign central bank redemptions of cash for physical gold. The signal to President Richard Nixon’s monetary authorities was that they had over-issued the dollar.

But rather than reduce dollar liquidity, or, restate the U.S.’s commitment to the gold/dollar standard, Nixon advised Fed Chairman Arthur Burns to continue printing money owing to the mistaken belief that money creation itself fostered economic growth. With an election looming, Nixon chose to sever the dollar’s link to gold on August 15, 1971. Nixon’s action devalued the U.S dollar and the inflation of the 1970’s began.

Fast forward to today, two issues need to be dealt with if the U.S wants to return to a commodity standard whereby the dollar is linked to gold. The first has to do with what is the appropriate gold-price target. Given the certain deflation that would result from a $35 gold fix, returning to the exact Bretton Woods standard would be highly inappropriate.

The second issue concerns how a new Bretton Woods-style monetary fix could avoid the mistakes of the late ‘60s and ‘70s where the lead country (the U.S.) over-issues the standard currency. Absent a credible commitment to maintaining a sound currency, any new system would quickly come undone.

What is the appropriate gold target price?

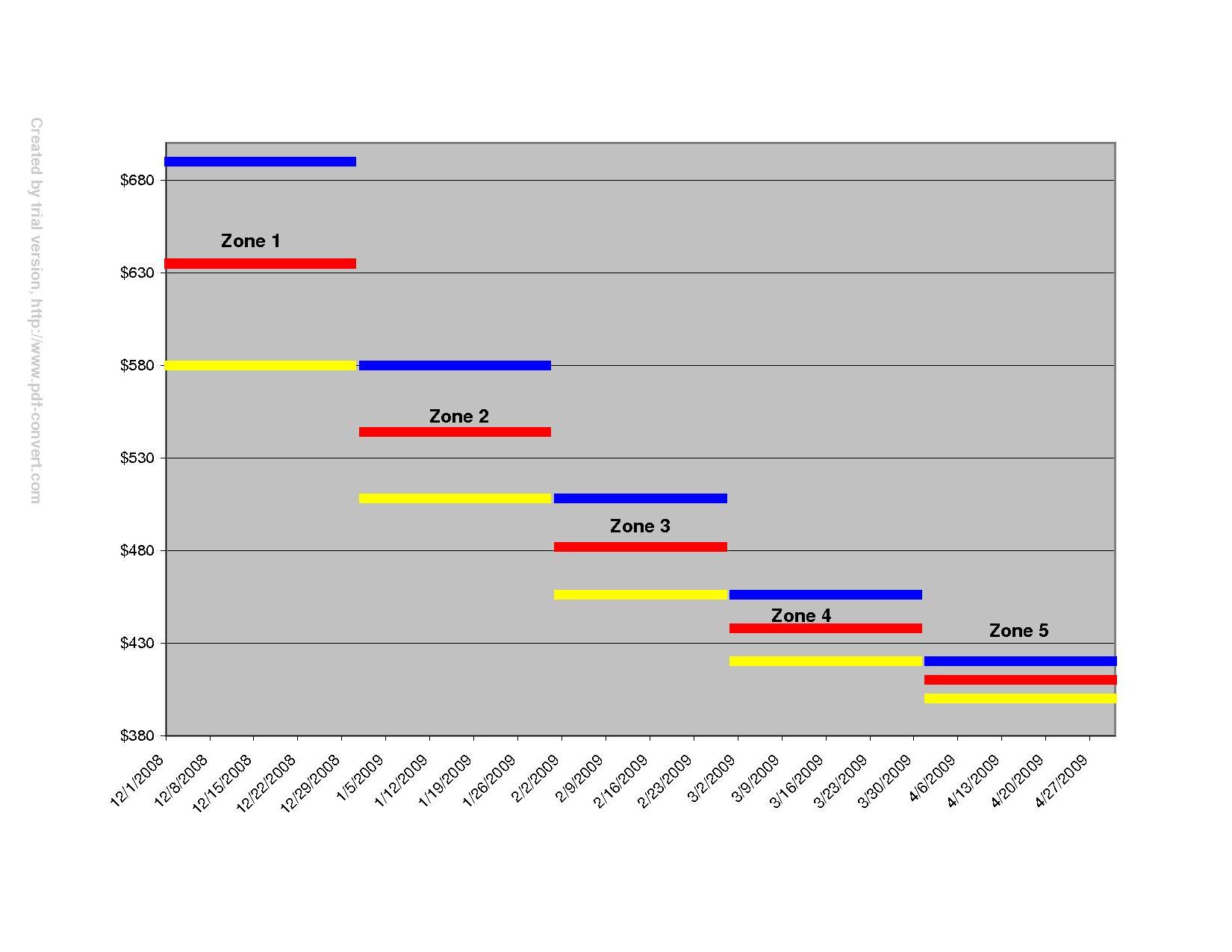

Long-term gold-price averages were calculated over different lengths of time below. The averages are the monthly mean price of gold using the London PM fix. The idea here is to let this market data tell us what the optimal gold price should be.

The first thing that becomes apparent when looking at these long-term averages is that the recent average prices are very high compared to the longer-dated ones. The second notable feature is the cluster of longer-term averages that includes the 15-year through 30-year averages, which all are in the $400/oz range. The third aspect is that the further we go out in time, the lower the mean price of gold.

Due to the volatility of floating exchange rates, returning to a specific optimum gold target will need to be a process, as opposed to the Treasury or Fed simply picking a gold price. The process will involve the utilization of longer-term averages to set up various stabilization zones. The zones will allow the price of gold to drift down and therefore allow the value of the dollar to increase. You can create a downward staircase approach in setting up the stabilization zones because of the sequential drop in the mean prices of gold.

As the above chart shows, each zone consists of the long-term averages. The high price for each zone is the shortest average in terms of time. The low price of each zone is a longer-term average, and therefore lower in price. To create symmetry a middle-price target is created. When two averages are very similar (8-year and 9-year) the longer dated average is used.

The Fed would target the middle price of each zone via open market operations. The price would float between the high and low end of each zone. If the gold price hits the high or low end of the band, then the Fed would act by driving the price back to the middle target price. Each stabilization zone would last one month.

To start this process, the Fed would state its intention of driving the gold price down to $635. This is exactly where the price will open because no one would be stupid enough to fight the Fed.

The process of setting the first trade as the middle price of each zone and letting the price float after will continue until the fifth zone is reached. If you start with the first trade in December, by April of 2009 the U.S would have optimum monetary policy for the first time in 37 years.

The great thing about the long-term mean prices is that they point us in the direction of picking the correct optimum target price. By setting the low end of the fifth zone as the 15-year average, we are also bringing in all the contracts created (and still in existence) over the last 30-years, because all mean prices between 15 and 30 years are $400 oz. This process would respect all the contracts set in dollars over the past 30 years.

Eventually the fifth zone would become permanent future monetary policy and gold prices would fluctuate between $420 and $400, with a middle target of $410. As you move from the first zone to the fifth zone, the volatility also sequentially falls. This means future gold volatility would range between 0% and 2.5%.

The result of eliminating monetary errors is that the wages that lag inflation would catch up to the ever-increasing prices that factor into daily living. Once this benefit is realized, the American people would act as a check on any FOMC seeking to impose monetary errors of inflation and deflation on the public’s wages and business contracts.

Stable monetary policy would also increase the forecasting ability of businesses. Prices often change due to monetary error, and when they do, false signals are sent to the marketplace, which exacerbates the business cycle. As time goes on, forecasting models will increase in accuracy: therefore, the business community will also act as a check on Fed activity when it comes to the dollar.

The Fed would become fully transparent by posting its daily open market operations on its website. Ultimately, these checks and balances on the Fed would get stronger as time goes on, thus making monetary errors a thing of the past.

![[Review & Outlook]](http://s.wsj.net/public/resources/images/OB-CT315_oj_1hi_E_20081201202244.jpg) AP

AP

7 comments:

You actually make it seem so easy with your presentation but I find this topic to be really something which I think I would never understand. It seems too complicated and extremely broad for me. I’m looking forward to your next post, I will try to get the hang of it!

cash for cars brisbane

cash for car brisbane

Great post. I used to be checking constantly this weblog and I am inspired! Extremely useful information specially the ultimate part :) I maintain such info much. I used to be seeking this particular information for a very lengthy time.

Thank you and good luck.

Cash for cars melbourne

Cash for cars melbourne city

We offer an easy way to get Cash For Honda Cars Brisbane wide. We buy Honda Cars and provide top dollars with Free Removals in Brisbane.

cash for honda brisbane

Cash for Car Removal Sunshine Coast · Get instant CASH for car removal Sunshine Coast up to $9999 for your unwanted car, van, UTE, SUV.

car removal sunshine coast

Best Wallpaper Installation And Best Wallpaper Seller In The UAE. Since 2009

We are the best at selling and fixing 3D Wallpapers in the UAE.

Our workers not only fix the wallpaper but they make perfect combinations and contrast as well.

Best wall decor in UAE

Paknance is Pakistan's 1st NFT Marketplace. Paknance aims to fuel the rise of a digital Pakistan, by providing Pakistani artist the ability to sell their art work to worldwide buyers of original and authentic content. The platform enables creators to earn royalties whenever the ownership of the asset changes hand.

Nft

Beymisaal

We have a large variety of women accessories to enhance your beauty. A huge variety of formal and informal accessories is available at affordable and impressive price. You can get the accessories to wear at parties or on any occasion from our store or just visit our website. Our website is https://beymisaal.com/

Post a Comment