Collapse of $1.2 quadrillion global derivatives market will lead to dollar collapse

By

Why? Simply because of the fact that it is highly unregulated. It is so unregulated that the Congress has declared it illegal to regulate it.

Bank of Canada makes disastrous Keynesian move in interest rate cut

By

The Bank of Canada (BoC) announced Wednesday that it would slash interest rates by 0.25 percent to a near record low of 0.7 percent amid declining oil prices and threats to unemployment and household debt levels. BoC Governor Stephen Poloz referred to this move as an “insurance” policy against a weak economy.

Five Lessons Learned from the Scottish Referendum

By Ryan McMaken

Government authorities in the UK have declared that the “Yes” campaign for secession has failed by a margin of approximately 55 percent to 45 percent. Yet, even without a majority vote for secession, the campaign for separation from the United Kingdom has already provided numerous insights into the future of secession movements and those who defend the status quo.

Lesson 1: Global Elites Greatly Fear Secession and Decentralization

Global elite institutions and individuals including Goldman Sachs, Alan Greenspan, David Cameron and several major banks pulled out all the stops to sow fear about independence as much as possible. Global bankers vowed to punish Scotland, declaring they would move out of Scotland if independence were declared.

According to one report:

Government authorities in the UK have declared that the “Yes” campaign for secession has failed by a margin of approximately 55 percent to 45 percent. Yet, even without a majority vote for secession, the campaign for separation from the United Kingdom has already provided numerous insights into the future of secession movements and those who defend the status quo.

Lesson 1: Global Elites Greatly Fear Secession and Decentralization

Global elite institutions and individuals including Goldman Sachs, Alan Greenspan, David Cameron and several major banks pulled out all the stops to sow fear about independence as much as possible. Global bankers vowed to punish Scotland, declaring they would move out of Scotland if independence were declared.

According to one report:

The True Cost of the Homeownership Obsession

By Ryan McMaken

In 2014, the US homeownership rate fell below 65 percent, which means it’s back to where it was during the 1970s and much of the 1990s. Various federal agencies have long made homeownership a priority, and have introduced a bevy of government and quasi-government programs including the GSEs like Fannie Mae, FHA-insured loans, VA-insured loans, the Bush administration’s “American Dream Downpayment Initiative” and, of course central bank meddling to keep interest rates nice and low for the mortgage markets.

In 2014, the US homeownership rate fell below 65 percent, which means it’s back to where it was during the 1970s and much of the 1990s. Various federal agencies have long made homeownership a priority, and have introduced a bevy of government and quasi-government programs including the GSEs like Fannie Mae, FHA-insured loans, VA-insured loans, the Bush administration’s “American Dream Downpayment Initiative” and, of course central bank meddling to keep interest rates nice and low for the mortgage markets.

Let’s Secede from the American Monetary Union

By Ryan McMaken

The Swiss central bank’s recent move to de-peg the Swiss franc from the euro reminds us of the importance of choice in currency. By pegging the Swiss franc to the euro, the Swiss central bank was in effect subsidizing the euro by refusing to compete with it. If carried into the long term, this would have meant a de facto monetary union between the euro and the franc. Fortunately for most people however, the Swiss central bank maintained its legal independence from the euro and the peg was eventually ended, thus freeing the holders of Swiss francs from the new round of money-supply inflation that is expected from the European Central Bank.

Black Gold Loses Glitter

By Peter Schiff

The stunning 40% drop in the price of oil over the past few months has scrambled global economic forecasts, changed the geo-political landscape, and has severely pressured many energy sector investments. Economists are scratching their heads to determine if the drop is good or bad for the economy or whether cheap oil will add to or decrease unemployment, or complicate the global effort to “defeat” deflation. While all of these issues merit detailed discussions, the first question to address is if the steep drop is here to stay and whether energy prices will stay low enough, for long enough, to seriously reshuffle the economic deck. Based on a variety of factors, this is not likely to happen. I believe a series of technical, industrial, and monetary factors will combine to push oil back up to, and potentially beyond, the levels that it has seen over the last few years.

Markets are still reeling from yesterday’s news that the Swiss

National Bank has removed the currency cap on the Swiss franc. Still

wondering exactly what this means for European and American investors?

Peter Schiff explains to RT what this means in the larger context of the

international currency war. It’s good news for the Swiss people, but

Americans still have a long way to go before losing confidence in the

Federal Reserve.

Switzerland Wins As Its Central Bank Surrenders

If

anyone had any doubt how severely the global economy has been distorted

by the actions of central bankers, the “surprise” announcement last

week by the Swiss National Bank (SNB) to no longer peg the Swiss franc

to the euro should provide a moment of crystal clarity. The decision

sent the franc up almost 30% in intraday trading, a scale of movement

that is unprecedented for a major currency in the modern era. Although

very few in the media or on Wall Street fully understand the

ramifications, the situation that forced the Swiss to abandon the peg

will soon be faced by bankers of much larger countries in the coming

years, the implications of which can have more profound implications for

global financial markets.

The Swiss Declare War By Bionic Mosquito

Well, that is what one might conclude after the events of the last week. As is well-known, the Swiss National Bank decided to remove the peg/floor in the exchange rate for the Franc against the Euro. This move was made suddenly, with no announcement or even a hint beforehand.

Who Will Keep Our Freedoms Safe? By Andrew P. Napolitano

While the Western world was watching and grieving over the slaughter in Paris last week, and my colleagues in the media were fomenting a meaningless debate about whether President Obama should have gone to Paris to participate in a televised parade, the feds took advantage of that diversion to reveal even more incursions into our liberties than we had known about.

US: Is James Rickards Right About A Coming Monetary Apocalypse? – by Ralph Benko

US: Is James Rickards Right About A Coming Monetary Apocalypse? – by Ralph Benko

Is a monetary apocalypse imminent?

James Rickards, bestselling author of Currency Wars, has a new New York Times bestseller out, about the possible imminent collapse of the dollar: The Death of Money: The Coming Collapse of the International Monetary System (Portfolio/Penguin). More interestingly, he writes about what could come next: a golden age.

US: Link dollar to gold or face Great Depression II – by Steve Forbes

US: Link dollar to gold or face Great Depression II – by Steve Forbes

Influential financial publisher and former presidential candidate Steve Forbes is out with a new warning that the U.S. faces an economic catastrophe due to the Federal Reserve‘s loose dollar policy, and returning to a strict “gold standard” is the only way to avoid disaster.

In Money: How the Destruction of the Dollar Threatens the Global Economy — and What We Can Do About It, Forbes blames President Obama‘s money team for the stagnant economy, high prices, declining mobility and big government.

Latin America And The USA: Creating More Win-Win Relationships – by Alejandro Chafuen

Latin America And The USA: Creating More Win-Win Relationships – by Alejandro Chafuen

Whenever

a Latin American country shares a headline with the U.S., it is usually

attached to a crisis. The flow of illegal immigrants coming from Mexico

and the unaccompanied children from troubled Honduras arriving to stay;

the Argentine government defying therulings of U.S. judges;

or the anti U.S. rhetoric and actions from countries that are admirers

of Cuban socialism. The saying “no news is good news” could be

complemented by saying, “good news is not news.” American audiences

rarely hear about good news coming from the region. This includes honest

discussions on why the U.S. government, as well as private actors,

should play a more intelligent and active role in the region.

US: Nanny Government Treats Its Citizens Like Children – by Walter E. Williams

US: Nanny Government Treats Its Citizens Like Children – by Walter E. Williams

Last month, at a Raeford, N.C., elementary school, a teacher confiscated the lunch of a 5-year-old girl because it didn’t meet U.S. Department of Agriculture guidelines and therefore was deemed non-nutritious. She replaced it with school cafeteria chicken nuggets.

The girl’s home-prepared lunch was nutritious; it consisted of a turkey and cheese sandwich, potato chips, a banana and apple juice.

But whether her lunch was nutritious or not is not the issue. The issue is governmental usurpation of parental authority.

US: Ayn Rand’s 108th birthday – I’m with the Rand – by Elizabeth Gettelman

US: Ayn Rand’s 108th birthday – I’m with the Rand – by Elizabeth Gettelman

Celebrity fans of the cult of selfishness.

Angelina Jolie: “I just think [Ayn Rand] has a very interesting philosophy…You reevaluate your own life and what’s important to you.”

Christina Ricci: “My favorite book is The Fountainhead…I relate to it because of the idea that you’re not a bad person if you don’t love everyone.”

Vince Vaughn: “The last book I read was the book I’ve been rereading most of my life—The Fountainhead.”

Margaret The Magnificent: We Desperately Need More Leaders Like Her – by Steve Forbes

Margaret The Magnificent: We Desperately Need More Leaders Like Her – by Steve Forbes

Along with Ronald Reagan and Pope John Paul II, Margaret Thatcher was a giant of our era and, indeed, of history. These three leaders brought about the fall of Soviet communism and the resurgence of political and economic liberty around the world. Like Reagan, Thatcher was one of those rare individuals who were both a movement leader and an effective political leader. It’s one thing to have firm ideas, quite another to have the skills to bring them into being and for them to endure after you leave office.

The current economic crisis has brought Margaret Thatcher’s ideas and ideals under siege, even though this disaster resulted from ignoring her, and Reagan’s, fundamental free-market principles.

US: Signs Of The Gold Standard Emerging From Great Britain? – by Ralph Benko

US: Signs Of The Gold Standard Emerging From Great Britain? – by Ralph Benko

Comes now to respectful international attention a volume entitledWar and Gold: A 500-Year History of Empires, Adventures, and Debt by

Member of Parliament Kwasi Kwarteng. This near-perfect volume appears

with almost preternaturally perfect timing around the centenary of the

beginning of World War I and, with that, the end of the classical gold

standard. It, along with the work of Steve Baker, MP (co-founder of the Cobden Centre), constitutes a sign of sophistication about the gold standard in the British House of Commons.

US: What really drives anti-fracking zealots? – by Paul Driessen

US: What really drives anti-fracking zealots? – by Paul Driessen

They want to end fossil fuels and capitalism, control our lives and impose eco-utopia.

Recent news stories underscore the tremendous benefits brought by America’s fracking revolution.

* The shale oil production boom could boost US crude production to 9.5 million barrels of oil per day (bopd) next year, reducing America’s crude oil imports to 21% of domestic demand, the lowest level since 1968. Output from fracked wells represents 43% of all US oil production and 67% of natural gas production; “frack oil” could hit 10 million bopd by 2016, the Energy Information Administration says.

11 Predictions Of Economic Disaster In 2015 From Top Experts All Over The Globe

Will 2015 be a year of financial crashes, economic chaos and the start of the next great worldwide depression? Over the past couple of years, we have all watched as global financial bubbles have gotten larger and larger. Despite predictions that they could burst at any time, they have just continued to expand. But just like we witnessed in 2001 and 2008, all financial bubbles come to an end at some point, and when they do implode the pain can be extreme. Personally, I am entirely convinced that the financial markets are more primed for a financial collapse now than they have been at any other time since the last crisis happened nearly seven years ago. And I am certainly not alone. At this point, the warning cries have become a deafening roar as a whole host of prominent voices have stepped forward to sound the alarm. The following are 11 predictions of economic disaster in 2015 from top experts all over the globe…

Who Is Behind The Oil War, And How Low Will The Price Of Crude Go In 2015?

Who is to blame for the staggering collapse of the price of oil? Is it the Saudis? Is it the United States? Are Saudi Arabia and the U.S. government working together to hurt Russia? And if this oil war continues, how far will the price of oil end up falling in 2015? As you will see below, some analysts believe that it could ultimately go below 20 dollars a barrel. If we see anything even close to that, the U.S. economy could lose millions of good paying jobs, billions of dollars of energy bonds could default and we could see trillions of dollars of derivatives related to the energy industry implode. The global financial system is already extremely vulnerable, and purposely causing the price of oil to crash is one of the most deflationary things that you could possibly do. Whoever is behind this oil war is playing with fire, and by the end of this coming year the entire planet could be dealing with the consequences.

Junk Bonds Are Going To Tell Us Where The Stock Market Is Heading In 2015

Do you want to know if the stock market is going to crash next year? Just keep an eye on junk bonds. Prior to the horrific collapse of stocks in 2008, high yield debt collapsed first. And as you will see below, high yield debt is starting to crash again. The primary reason for this is the price of oil. The energy sector accounts for approximately 15 to 20 percent of the entire junk bond market, and those energy bonds are taking a tremendous beating right now. This panic in energy bonds is infecting the broader high yield debt market, and investors have been pulling money out at a frightening pace. And as I have written about previously, almost every single time junk bonds decline substantially, stocks end up following suit. So don’t be fooled by the fact that some comforting words from Janet Yellen caused stock prices to jump over the past couple of days. If you really want to know where the stock market is heading in 2015, keep a close eye on the market for high yield debt.

It’s WAR On The Streets Of America

Make no mistake – there is now a state of open warfare on the streets of America. Earlier this year it was being reported that the number of police officers killed on the job was up 40 percent in 2014, and that was before all of the civil unrest caused by the deaths of Michael Brown and Eric Garner. At this point, attacks on police officers are becoming a frequent occurrence all over the country, but no incident has stunned the nation as much as the “execution-style” murder of two NYPD officers on Saturday by a radical Islamic gunman identified as Ismaaiyl Brinsley. Just prior to the attack, Brinsley posted a message on Instagram in which he declared that he was “putting wings on pigs today”. Many would like to dismiss this as an “isolated incident” and pretend that everything is just fine in America, but that is not the truth. The reality of the matter is that anti-police sentiment in this country is at an all-time high, and the level of anger and frustration in our increasingly radicalized urban communities has reached a boiling point.

All Over America, Government Officials Are Cracking Down On Preppers

Why would the government want to punish people that are just trying to work hard, become more self-sufficient and take care of their families? There are approximately 3 million preppers in the United States today, and often they appear to be singled out for punishment by bureaucratic control freaks that are horrified at the thought that there are families out there that actually want to try to become less dependent on the system. So if you use alternative methods to heat your home, or if you are not connected to the utility grid, or if you collect rainwater on your property, or if you believe that parents should have the ultimate say when it comes to health decisions for their children, you could become a target for overzealous government enforcers. Once upon a time, America was the land of the free and the home of the brave, but now we are being transformed into a socialist police state where control freak bureaucrats use millions of laws, rules and regulations to crack down on anyone that dares to think for themselves.

Obama Declares War On ‘Extremism’ – Are You An ‘Extremist’ According To His Definition?

Do you know what an “extremist” is? In the wake of the horrible terror attacks on the offices of Charlie Hebdo in France, Barack Obama is speaking very boldly about the need to win the war against “extremists”, and he has announced plans to host a major global summit on “extremism” next month. And on the surface that sounds great. But precisely how are we supposed to determine whether someone is an “extremist” or not? What criteria should we use? As you will see below, your definition of an “extremist” may be far, far different from the definition that Barack Obama is using. When you do a Google search, you will find that an “extremist” is defined as “a person who holds extreme or fanatical political or religious views, especially one who resorts to or advocates extreme action.” According to Wikipedia, “extremism” is “an ideology (particularly in politics or religion), considered to be far outside the mainstream attitudes of a society or to violate common moral standards. Extremism can take many forms, including political, religious and economic.” Please notice that neither of those definitions uses the word violence. In this day and age, you can be considered an “extremist” simply based on what you believe, and as you will see later in this article there are now tens of millions of Americans that are considered to be “extremists” and “potential terrorists” according to official U.S. government documents.

Swiss Shocker Triggers Gigantic Losses For Banks, Hedge Funds And Currency Traders

The absolutely stunning decision by the Swiss National Bank to decouple from the euro has triggered billions of dollars worth of losses all over the globe. Citigroup and Deutsche Bank both say that their losses were somewhere in the neighborhood of 150 million dollars, a major hedge fund that had 830 million dollars in assets at the end of December has been forced to shut down, and several major global currency trading firms have announced that they are now insolvent. And these are just the losses that we know about so far. It will be many months before the full scope of the financial devastation caused by the Swiss National Bank is fully revealed. But of course the same thing could be said about the crash in the price of oil that we have witnessed in recent weeks. These two “black swan events” have set financial dominoes in motion all over the globe. At this point we can only guess how bad the financial devastation will ultimately be.

12 Signs That The Economy Is Really Starting To Bleed Oil Patch Jobs

The gravy train is over for oil workers. All over North America, people that felt very secure about their jobs just a few weeks ago are now getting pink slips. There are even some people that I know personally that this has happened to. The economy is really starting to bleed oil patch jobs, and as long as the price of oil stays down at this level the job losses are going to continue. But this is what happens when a “boom” turns into a “bust”. Since 2003, drilling and extraction jobs in the United States have doubled. And these jobs typically pay very well. It is not uncommon for oil patch workers to make well over $100,000 a year, and these are precisely the types of jobs that we cannot afford to be losing. The middle class is struggling mightily as it is. And just like we witnessed in 2008, oil industry layoffs usually come before a downturn in employment for the overall economy. So if you think that it is tough to find a good job in America right now, you definitely will not like what comes next.

At one time, I encouraged those that were desperate for employment to check out states like North Dakota and Texas that were experiencing an oil boom. Unfortunately, the tremendous expansion that we witnessed is now reversing…

Wednesday, January 21, 2015

Pat Buchanan: Obama is a Pawn of Muslim Rulers

“Once war is forced upon us, there is no other alternative than to apply every available means to bring it to a swift end. War’s very object is victory, not prolonged indecision.”

So said Gen. MacArthur in some of the wisest counsel the old soldier ever gave his countrymen.

Yet, “prolonged indecision” would seem the essence of the war the president has begun to “degrade and ultimately destroy” the Islamic State. For, following only one night of bombing in Syria, Gen. Bill Mayville, director of operations for the Joint Chiefs, asked to estimate how long this new war would last, replied: “I would think of it in terms of years.”

“Years,” the general said.

Eric Holder’s Destructive Racial Legacy

Eric Holder has announced his resignation from his position as U.S. attorney general after almost six years of turning the Justice Department into a partisan political vehicle instead of a law enforcement institution.

It’s too early to tell as of this writing what prompted his resignation. One would like to think his legacy of scandals and corruption finally caught up to him, but we have no reasonable expectation that this is the case, given this administration’s agility at escaping accountability for any and all wrongdoing.

Obama’s Foreign Policy Bucks American Tradition

President Obama’s speech at the United Nations last week was “an important turning point in American foreign policy — and in his presidency.”

That’s the verdict of Brookings Institution scholar and former Clinton White House aide William Galston, a Democrat who has not been an unqualified admirer of this Democratic president’s foreign policy.

Whether Obama’s decision to launch air strikes against the Islamic State of Iraq and Syria and Khorasan terrorists is a turning point, it was at least a move in the direction of a tradition in American foreign policy that has been conspicuously lacking in his administration.

Obama Administration Leads From Behind on Ferguson

|

In July of 1967, after race riots gutted Newark and Detroit, requiring troops to put them down, LBJ appointed a commission to investigate what happened, and why.

The Kerner Commission reported back that “white racism” was the cause of black riots. Liberals bought it. America did not.

Richard Nixon said of the white racism charge that there is a “tendency to lay the blame for the riots on everyone but the rioters.”

What Obama Should Have Said: “I Screwed Up, I’m Sorry”

President Obama sure is consistent. His State of the Union address sounded like his other speeches: What I’ve done is great! America is in a much better position. We’ve created a manufacturing sector that’s adding jobs. More oil is produced at home. I cut deficits in half!

Give me a break. The deficit is lower now not because of any prudence on Obama’s part but merely because the $800 billion stimulus spending blowout didn’t continue. All the president does is increase spending: free community college, free Obamaphones, free birth control, etc. Yes, our annual deficit is lower, but it’s still $488 billion! Our $18 trillion national debt increases by $3 million every minute!

Manufactured Hate Crime Blamed on “Chubby Gray Alien”

COLORADO SPRINGS — From the liberal media’s coverage of my beautiful adopted hometown, you’d think we live in a KKK-infested hotbed where every person of color fears for his or her life.

Take a look at these ominous headlines:

–“Bombing of NAACP headquarters harkens to bad old days” — MSNBC

–“Colorado Springs explosion recalls violence against NAACP” — The Washington Post

–“NAACP Bombing Evokes Memories of Civil Rights Strife” — Time magazine

–“Explosion outside NAACP office could be a hate crime, officials say” — Los Angeles Times

Let me and my brown skin assure you, America: Bull Connor is not running loose on our streets. Water fountains here in the Rocky Mountain West are segregated by height, not race. The only bonfires I know of are being set outside by local residents roasting s’mores.

Never one to let reality intrude on a ripe race hustle, Texas Democratic Rep. Sheila Jackson Lee claimed last week that the so-called NAACP bombing “undermines years of progress” and now “demands federal review” of the case. Georgia Democratic Rep. John Lewis, who clearly missed the thousands of local, state, national and international newspaper, magazine, web and cable news stories on the incident, lamented: “It reminds me of another period. These stories cannot be swept under the rug.” Professional agitator and social justice detective Shaun King, based in Ferguson, Mo., accused a phantom “domestic terrorist” of perpetrating the alleged crime. CNN immediately blared an apocalyptic headline about my town that invoked “domestic terrorism” (this from the feckless news channel that pixelates Mohammed cartoons and whitewashes proven jihadi terrorism). And the national president of the NAACP is now headed out here for a visit this weekend.

Obama’s Class-Warfare Tax Plan Targets the So-Called Rich, but Workers Will Bear the Burden

But if I had to pick a graph that belongs in second place, it would be this relationship between investment and labor compensation.

But if I had to pick a graph that belongs in second place, it would be this relationship between investment and labor compensation.The clear message is that workers earn more when there is more capital, which should be a common-sense observation. After all, workers with lots of machines, technology, and equipment obviously will be more productive (i.e., produce more per hour worked) than workers who don’t have access to capital.

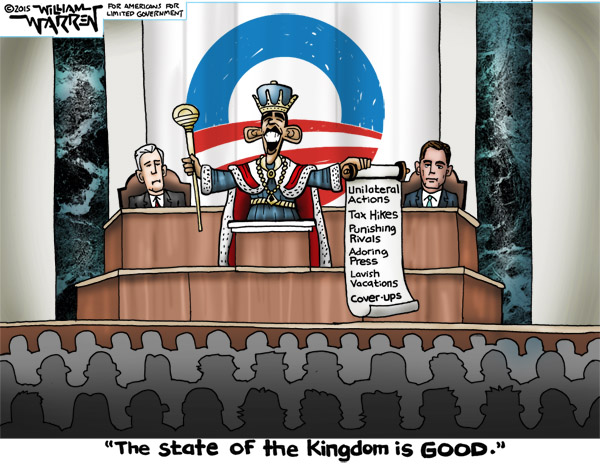

The State of the Union is Not Strong

by Dan Mitchell

Which is why, in the past, I’ve heartily recommended the State-of-the-Union Bingo game developed

by Americans for Tax Reform.

by Americans for Tax Reform.But I was in New York City for a television program about the President’s address, so I had to pretend I was an adult and pay attention to the speech.

That being said, the silver lining to that dark cloud is that the folks at U.S. News and World Report gave me an opportunity to add my two cents to an online debate on whether the President was correct to assert that the state of the union is strong.

In my contribution, I combined some dismal economic indicators and bad policy developments to argue that America could – and should – be doing much better.

Here are the bullet points from my article.

No comments:

Post a Comment